Building for the Exit: The Difference Between a Living and an Empire

Ask yourself this brutal question:

“If I disappear tomorrow, how much is what I’ve built worth?”

Not how much it generates. How much someone would pay to own it.

If you’re a freelancer, consultant, or “face-based” content creator, the answer is painful: Zero.

Your business is you. Your time, your expertise, your personality. You can’t sell a person (that’s been illegal for a while).

The Economic Architect starts with the end in mind. He doesn’t build to manage his system forever. He builds to have the choice to sell it.

The Difference Between a Job and an Asset

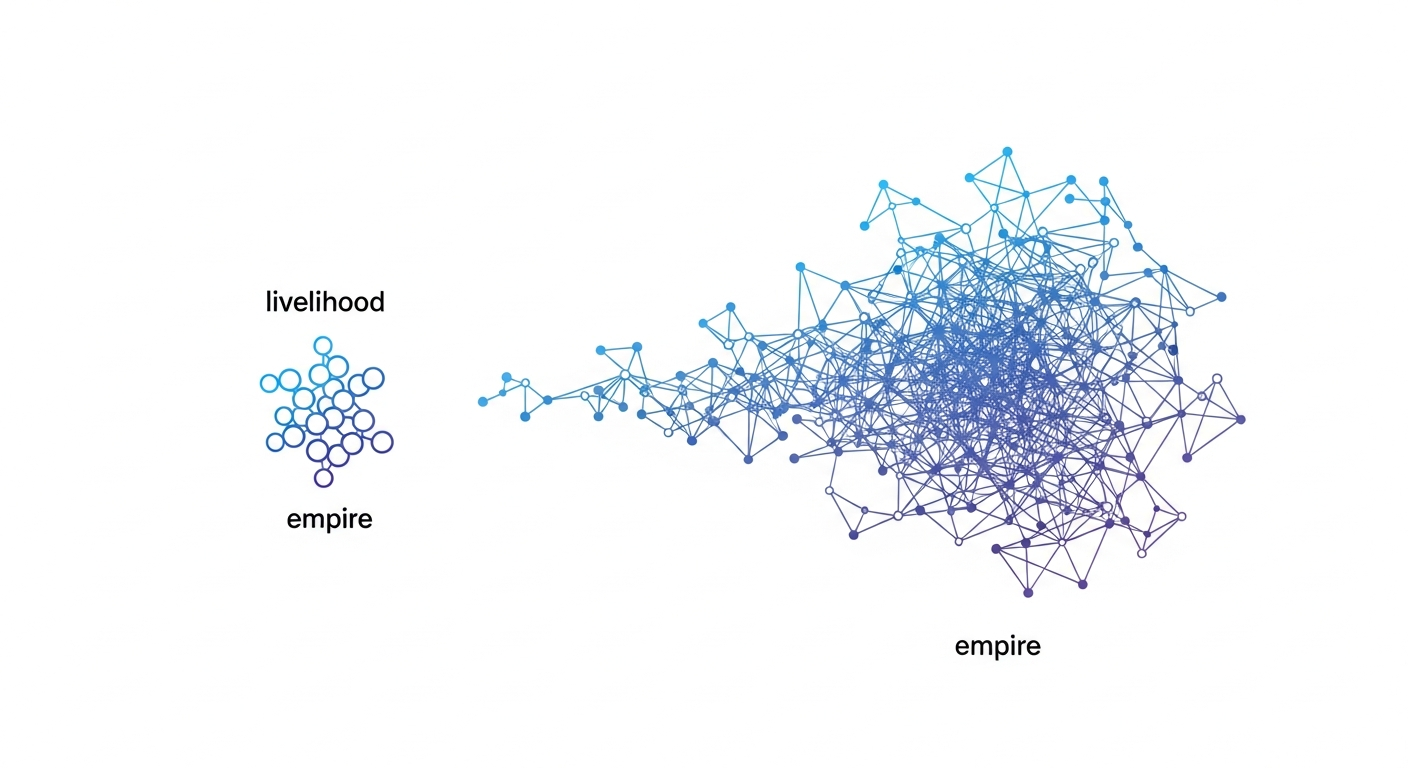

What You’ve Probably Built

Most online entrepreneurs have built a disguised job:

- Income tied to their presence

- Clients who buy “them” (their time, their expertise)

- No process documentation

- Impossible to delegate without massive quality loss

- Resale value: $0

It’s better than a salaried position (you’re your own boss), but it’s still a time-for-money exchange.

What an Architect Builds

The Architect builds a transferable asset:

- Income uncorrelated to his presence

- Clients who buy the system (the value, not the person)

- Documented and automated processes

- Delegable or sellable without loss

- Resale value: 3x to 5x annual profits

That’s the difference between having a job and owning a business.

The AES is a Financial Product

A well-architected AES (Autonomous Economic System) isn’t just a business.

It’s a liquid financial asset.

Why an AES is Sellable

Because it possesses the 4 characteristics buyers seek:

1. Documentation Every process is written. A buyer can understand how everything works in a few hours.

2. Automation The system runs without constant intervention. The buyer isn’t buying a job, they’re buying a machine.

3. Decoupling Revenue doesn’t depend on a specific person. The brand is systemic, not personal.

4. Predictability Revenue is stable and documented. The buyer can project the ROI of their investment.

AES Valuation

Online business sale marketplaces (Empire Flippers, Flippa, MicroAcquire) generally use these multiples:

| Business Type | Annual Profit Multiple |

|---|---|

| Content site dependent on founder | 1x - 1.5x |

| Semi-automated niche site | 2x - 3x |

| Fully autonomous AES | 3x - 5x |

| SaaS with recurring revenue | 4x - 7x |

Concrete example:

Two businesses generate $100,000 annual profit.

Business A (Operator):

- Depends on founder’s charisma

- Requires 60h work/week

- No documentation

- Resale price: Unsellable (or $50K max with a lot of luck)

Business B (AES):

- Managed by an AEP

- 2h maintenance/week

- Completely documented

- Anonymous brand

- Resale price: $300K to $500K cash

Same revenue. Radically different wealth value.

Building with Exit in Mind

The classic mistake: build first, think about sale later.

The problem: bad decisions made at the start (personal branding, undocumented processes, founder dependence) are almost impossible to correct afterward.

Day 1 Decisions That Maximize Exit

Systemic brand vs Personal Brand From the start, create a brand that can exist without you. Neutral domain name. Not your face everywhere.

Obsessive documentation Every process, every decision, every configuration must be documented. Use Notion, an internal wiki, or your AEP’s documentation features.

Maximum automation Every manual task is a valuation debt. Automate everything that can be.

Revenue diversification A business with 3 revenue sources is worth more than one with 1 source (even at equal revenue).

Clean metrics Keep clear analytics, monthly P&Ls, projections. Buyers want data, not approximations.

The System Flipping Strategy

Thanks to an AEP like FlowContent’s deployment speed, a new strategy emerges: System Flipping.

The Concept

Instead of spending 10 years on the same project hoping for a hypothetical exit, the Architect can:

- Detect a niche with AI (1-2 days)

- Build a MEP (Minimum Economic Platform) (48-72h)

- Grow to $1,000-2,000/month stable revenue (3-6 months)

- Sell on a marketplace for 24-36x monthly revenue

Flip Numbers

| Metric | Value |

|---|---|

| Build time | 48-72h |

| Growth time | 3-6 months |

| Target monthly revenue | $1,500/month |

| Sale multiple | 30x monthly |

| Sale price | $45,000 |

| Total time invested | ~100h |

| Effective hourly rate | $450/h |

And this calculation doesn’t count revenue generated during the growth phase.

The Flip Portfolio

An advanced Architect can manage 3-5 MEPs in parallel.

- 2 in build phase

- 2 in growth phase

- 1 in sale phase

It’s an asset pipeline. Each quarter, a new system exits the pipeline and generates a $30-50K payment.

Sale Marketplaces

Where to sell your AES?

For Small Amounts (< $50K)

Flippa

- The largest marketplace

- High volume, variable quality

- Fees: 5-15% depending on amount

MicroAcquire

- Focus on startups and SaaS

- Free for sellers

- More sophisticated buyers

For Medium Amounts ($50K - $500K)

Empire Flippers

- Rigorous due diligence

- Qualified buyers

- Fees: 15% (but higher sale prices)

FE International

- Specialized in e-commerce and SaaS

- Premium support

For Large Amounts (> $500K)

Specialized brokers

- Custom negotiation

- Access to institutional buyers

- Negotiable fees (8-12%)

Exit as Ultimate Freedom

Exit isn’t mandatory. Some Architects keep their systems indefinitely.

But having the choice to sell changes everything.

What Exit Represents

Instant financial freedom A $300K exit = 10 years of revenue from a $30K/year system, but all at once.

Complete reset You can start from scratch with significant capital. New niches, new projects, new life.

Ultimate validation Someone paid for what you built. It’s definitive proof that you created real value.

Simplified inheritance A bank account is easier to pass on than a complex system.

Don’t Build a Golden Prison

Most entrepreneurs build without thinking about the exit.

They create businesses that generate revenue… but that imprison them.

They can’t:

- Take long vacations

- Get sick

- Change their life

- Retire

Their “success” is their cage.

The Architect builds differently. He builds an asset that has value on the secondary market.

An asset he can:

- Keep and run

- Completely delegate

- Sell to the highest bidder

- Bequeath to his children

That’s true economic freedom.

Don’t build a living. Build a sellable empire.